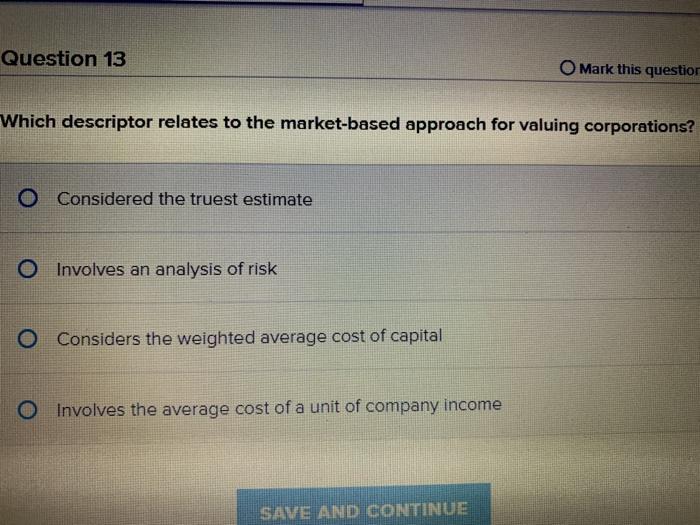

When delving into the intricate world of corporate valuation, one may ponder: which descriptor aptly encompasses the essence of a market-based approach to valuing corporations? This question dances on the precipice of financial theory and practical application, evoking a myriad of considerations—enough to pose a stimulating intellectual challenge. The market-based approach, standing as a pillar of corporate valuation methodologies, invites exploration into several critical descriptors that illuminate its mechanics.

The concept of valuation itself is far from monolithic; it burgeons into various dimensions, each method possessing unique attributes and implications. The market-based approach, often regarded as a comparative ignitor, fundamentally relies on robust market data to ascertain the value of a company. Perhaps the most salient descriptor associated with this approach is “comparable company analysis.” This term encapsulates the essence of examining peer firms within the same industry to derive a valuation benchmark. By evaluating the financial metrics of these comparable entities—such as price-to-earnings (P/E) ratios, enterprise value to EBITDA multiples, and revenue multiples—analysts glean insights that frame a relative value perception.

Transitioning from a theoretical standpoint to practical application, one might ask: how does the comparative company analysis manifest in real-world scenarios? Consider, for instance, two competing tech firms—Firm A and Firm B. If Firm A seeks to gauge its market position, it must dissect Firm B’s valuation metrics with the intent of positioning itself appropriately within the market continuum. This methodology rests on the principle that market participants will inherently seek to pay a price reflective of comparable firms, thus rendering the valuation process reliant on external benchmarks.

While the comparison of similar companies yields invaluable insights, it is also met with inherent challenges. One pressing dilemma arises from the question of comparability itself. Are Firm A and Firm B truly alike, or do qualitative variables—such as geographical reach, market share, or growth potential—obfuscate their respective valuations? A distinct cohort of analysts advocates for the use of “precedent transactions” as another descriptor associated with the market-based approach. This method involves scrutinizing historical transaction data of similar companies, offering a prism through which prospective buyers can view value propositions based on market realities.

Similar to the comparable company analysis, precedent transactions emerge from the labyrinthine marketplace, where actual sale prices serve as tangible empirical evidence. A brief introspection reveals that utilizing past acquisition prices equips stakeholders with a nuanced understanding of market sentiment, poised to reflect zeitgeist-driven economic dynamics. Notably, the prevailing socio-economic climate can pivot drastically, influencing the perceived value during different eras, thereby necessitating vigilant adjustments in valuation models. Observing these shifts highlights the acumen required of analysts to predict future transactions with acuity.

But, can the reliance on historical data render an organization’s valuation obsolete in the presence of market volatility? This notion conjures the idea of “market sentiment”—an intangible descriptor that embodies psychological undercurrents influencing investors. In reality, market valuations are not solely derived from quantitative metrics; they are also undergirded by the perceptions and expectations of market participants. As investors attune themselves to fervent shifts—triggered by regulatory changes, technological disruptions, or even consumer trends—their collective sentiment wields remarkable influence over stock prices. Thus, it would be remiss to understate the import of behavioral finance when appraising a corporation’s value in the market-based paradigm.

To augment this discourse, another pertinent descriptor emerges: “discounted cash flow (DCF) considerations” within the market context. While DCF is predominantly characterized as a fundamental approach to valuations, it possesses resonant significance in market-based analyses when juxtaposed against competitive market data. An astute analyst may deploy DCF alongside market metrics to derive a robust valuation that encompasses both intrinsic and market perspectives—bridging potential discrepancies that quantitative models may overlook.

Moreover, the growing prevalence of artificial intelligence and big data analytics is reshaping the foundation of valuation practices. The agility supplied by cutting-edge analytics tools enables thorough market segmentation, better understanding of consumer behavior, and enhanced predictive capabilities. Analysts equipped with these tools can synthesize expansive datasets to refine their valuation assessments, ensuring that they remain astutely grounded in contemporary market conditions. Thus, the descriptor “data-driven analysis” surfaces as an essential component of modern market-based evaluations, transcending its erstwhile methodological limitations.

Ultimately, one might arrive at an inherent paradox: while the descriptors associated with the market-based approach—comparable company analysis, precedent transactions, market sentiment, and data-driven analyses—embody the principles of rigorous valuation, they also unveil an intricate tapestry of challenges. The delicate balance of leveraging empirical data while acknowledging qualitative variables encapsulates the art and science of valuing corporations in an ever-evolving economic landscape.

So, what encompasses the descriptor that relates to the market-based approach for valuing corporations? It is far more than a mere label; it is a comprehensive framework, punctuated with interdependencies, nuances, and a quicksilver connection to shifting market paradigms. As analysts strive to decode the labyrinth of market signals, understanding the interplay of these descriptors not only refines their methodologies but also equips them to navigate the unpredictable terrain of corporate valuation with gravitas.