In the tumultuous world of finance, the prospect of bankruptcy can be daunting. Picture yourself facing insurmountable debts and an uncertain future. Now, imagine trying to regain some semblance of normalcy amidst this upheaval. One pressing question arises: Which banks allow bankrupt individuals to open a basic account? This inquiry not only encapsulates an essential financial need but also highlights a myriad of challenges surrounding fiscal rehabilitation. Understanding financial access post-bankruptcy is crucial for anyone venturing down this tumultuous path.

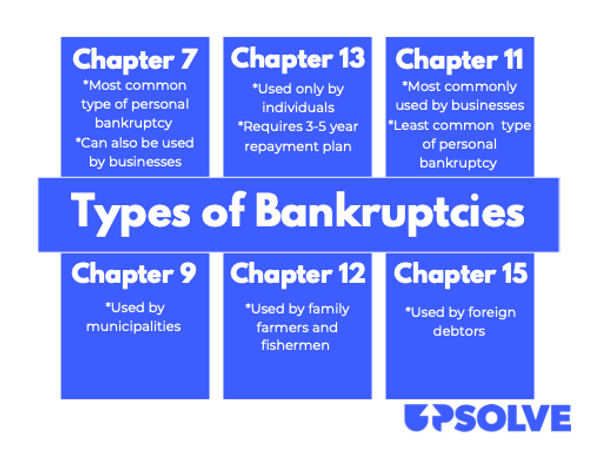

To navigate through this labyrinth of options, it is imperative first to grasp what bankruptcy entails. Essentially, it is a legal process that provides relief to individuals or businesses overwhelmed by debt. While this process may offer a fresh start, it often leaves a scar on one’s credit history. As the saying goes, “once bitten, twice shy.” Many banks, wary of risk, might hesitate to provide services to those who have previously declared insolvency. Thus, individuals are left wondering: can they secure a basic bank account, or will they be perpetually ostracized in this financial arena?

Surprisingly, several banks and financial institutions recognize the imperative need for basic financial services, even for those with bankruptcy histories. Let us embark on a thorough examination of the financial landscape, identifying banks that are inclined towards inclusivity and providing options for those seeking to re-establish their financial footing.

First on the list are **credit unions**. Unlike traditional banks, credit unions are member-owned institutions that often prioritize community needs over profit. Many credit unions offer basic checking accounts with minimal fees and no minimum balance requirements. Furthermore, they may be more lenient in their account approval criteria. This makes credit unions a formidable option for individuals looking to open an account post-bankruptcy. In essence, making use of local resources such as credit unions grants opportunities for building a more solid financial foundation.

Next, we have several **online banks** stepping up to fill the void of traditional banking institutions. These digital banks, characterized by lower operating costs, typically offer fewer restrictions. Companies like Chime and Simple often cater to individuals with less-than-stellar credit histories. Their straightforward account management systems, devoid of hidden fees and maintenance charges, promote financial empowerment and accessibility. Consequently, online banking has developed into a feasible pathway for those in financial limbo due to bankruptcy.

Furthermore, exploring **second-chance checking** accounts is an apt alternative. Numerous banks, including *Bank of America* and *Wells Fargo*, provide such accounts uniquely tailored for individuals considered high-risk. These accounts allow access to basic banking functions while offering a chance to rebuild one’s financial reputation. Although second-chance accounts often come with fees and fewer features than standard accounts, they serve a significant purpose in restoring financial stability.

Another avenue worth investigating is the realm of **neobanks**. These are digital-only banks that often boast a user-friendly interface and flexible account structures. Neobanks like *Varo* and *N26* have reshaped conventional banking paradigms. Typically, they impose fewer restrictions and can facilitate a smooth banking experience for individuals in post-bankruptcy recovery. As the financial landscape continues to evolve, the rise of neobanks signifies a progressive outlook towards inclusion in financial services.

Moreover, it is worth mentioning that some **traditional banks** may still extend their services to individuals with a bankruptcy record. Establishing a *relationship banking* approach can prove beneficial here; if a customer has held an account in good standing prior to declaring bankruptcy, banks like *Chase* or *PNC Bank* may consider reopening the account. Building a rapport with your banking institution often leads to mutual understanding, and in doing so, financial access may no longer be an elusive dream.

As one traverses the landscape of banks and financial institutions, there is a pressing challenge: understanding the nuanced requirements of different banks. Each institution has its own set of guidelines governing account eligibility, which can vary widely. For instance, while some banks may simply require proof of identity, others might seek comprehensive documentation regarding the bankruptcy discharge. Consequently, prospective account holders should prepare themselves with requisite documents that attest to their current financial standing.

In addition to understanding specific banking requirements, it’s vital to consider maintenance fees associated with different accounts. Many establishments offer low-fee or fee-free basic accounts, which can be an attractive feature for those just recovering. Consequently, weighing the costs against the benefits is paramount to ensure that revitalizing one’s financial world does not come at an unsustainable expense.

Lastly, consider the long-term trajectory of financial wellness. Reestablishing access to banking services is a stepping stone towards rebuilding credit. Regularly using a checking or savings account can demonstrate fiscal responsibility, ultimately paving the way for better financial products in the future. Past bankruptcy does not have to define one’s financial future, and having a basic banking account can serve as a foundation for new beginnings.

In conclusion, the journey towards reclaiming financial dignity after bankruptcy may present formidable challenges, yet it is not insurmountable. With various banking options tailored for individuals recovering from insolvency, basic accounts remain within reach. Whether through a credit union, online bank, or second-chance account, the keys to financial access are becoming increasingly available. The question remains: are you ready to take charge of your financial future? Embarking on this journey necessitates resilience, informed choices, and an unwavering commitment to financial literacy.