The Alternative Minimum Tax (AMT) serves as an enigmatic force within the labyrinth of the U.S. tax system. At its essence, the AMT acts as a parallel track designed to ensure that individuals and corporations pay a minimum level of tax, thereby functioning as a financial safeguard against the potential erosion of the tax base through deductions, credits, and exemptions that might otherwise lower tax liability disproportionately. In this discourse, we shall embark upon an exploration of the multifaceted characteristics that define the AMT, rendering it uniquely appealing yet complex in its implementation.

The inception of the AMT can be likened to the creation of a safety net woven from an amalgamation of economic prudence and fiscal equity. This fiscal instrument was initially instituted in 1969 to curtail the burgeoning phenomenon in which high-income earners utilized tax preferences to eliminate their liability entirely. The AMT encapsulates several distinguishing traits that merit elucidation.

1. Dual Tax Structure

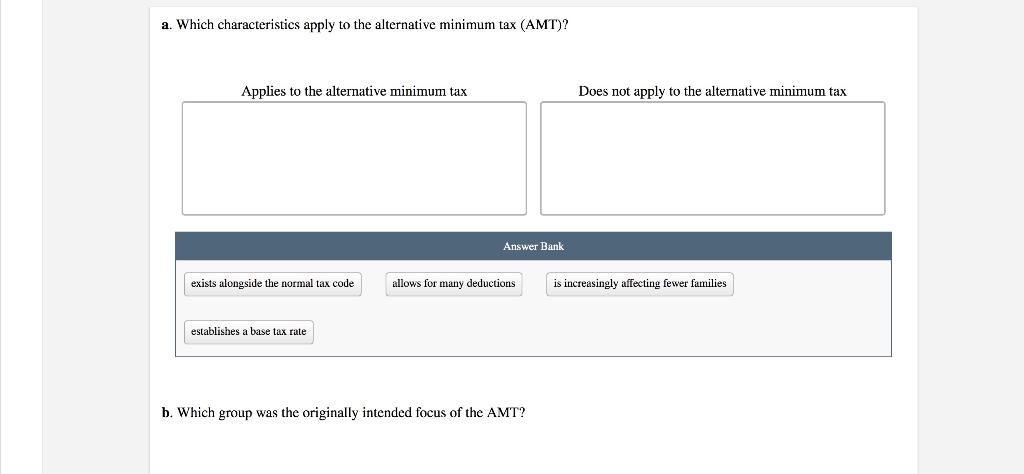

At the crux of the AMT is its dual tax structure. This dual framework operates alongside the traditional federal income tax, creating parallel calculations to determine an individual’s tax responsibility. Taxpayers are compelled to compute their tax obligations under both the standard tax regimen and the AMT to ascertain which expunges a higher financial tribute. This dual calculation serves as a checkpoint, ensuring that high-income earners do not escape their tax liabilities through various deductions.

2. Disallowance of Common Deductions

One of the hallmark characteristics of the AMT is the disallowance of numerous deductions that are ubiquitous in standard tax calculations. Specifically, while taxpayers may pocket deductions for mortgage interest, certain business expenses, and state taxes under the regular tax system, these are often stripped away under the AMT calculation. This action generates a broader tax base and alters the landscape of financial responsibility amongst taxpayers. As a result, taxpayers may find themselves bewildered as they navigate this intricate tax terrain.

3. Exemption Tiers

Embedded within the AMT framework is the concept of exemption tiers, which operate as ephemeral floating markers that delineate who is subject to the tax. These exemptions are adjusted annually for inflation, mirroring the ebb and flow of economic conditions. However, the resultant figures are often enigmatic; those above the exemption threshold face a progressive tax rate, currently set at 26% or 28%, depending upon their taxable income. This tiered structure underscores a fundamental tenet of the AMT: those wielding greater financial resources should contribute a commensurate portion of their wealth back to the public coffers.

4. Phase-Out Mechanism

The phase-out mechanism embedded in the AMT operates as a kind of financial trial, straddling the line between accessibility and responsibility. For high-income earners, the exemption diminishes incrementally beyond certain income thresholds, thereby entailing that as one ascends the income ladder, the diminishing returns on the AMT exemption become apparent. This characteristic serves to reinforce a significant message: higher earnings entail heightened accountability to the tax system.

5. Strategic Financial Planning

The presence of the AMT necessitates a reevaluation of financial strategies and tax planning methodologies. For individuals and corporations alike, a robust understanding of the AMT’s implications can inform decisions surrounding investment choices, charitable contributions, and property acquisitions. Professional advisors often advise affected taxpayers to engage in proactive planning to mitigate potential AMT exposure. This strategic foresight is akin to navigating a complex chessboard, where foresight and meticulous planning can yield tangible benefits.

6. Impact on Investment Choices

The AMT’s influence extends beyond immediate tax liabilities, permeating the very fabric of investment decisions made by taxpayers. Certain investments, such as municipal bonds, are largely exempt from the AMT, rendering them an appealing option for those attempting to circumvent the tax’s reach. Conversely, tax shelters designed to facilitate capital gains may inadvertently trigger AMT consequences, prompting investors to scrutinize their portfolios with a discerning eye.

7. Frequent Adjustments and Reforms

In a perpetual state of flux, the AMT has undergone a myriad of adjustments and reforms over the decades. Tax legislation, such as the Tax Cuts and Jobs Act of 2017, significantly altered the AMT landscape by raising exemption limits, thereby reducing its applicability for many taxpayers. Yet, as the socioeconomic environment evolves, so too may the legislative adaptations surrounding the AMT. The dynamic nature of tax policy indicates that taxpayers must remain vigilant, tracking an ever-changing regulatory terrain that can impact their fiscal responsibilities significantly.

8. Controversial Nature

The AMT remains a profoundly controversial component of the tax code. Critics argue that it disproportionately affects middle-class taxpayers unwittingly ensnared by the complexities of the tax system, while proponents assert its necessity in safeguarding equity. Frequently, the discourse surrounding the AMT reflects broader societal values regarding taxation and wealth distribution, creating a rich tapestry of dialogue that transcends the mere mechanics of tax policy.

In conclusion, the Alternative Minimum Tax stands as a multifaceted and complex instrument within the U.S. tax framework. Through its dual structure, restrictions on deductions, exemption tiers, and strategic implications for financial planning, the AMT compels taxpayers to engage more comprehensively with their fiscal responsibilities. Navigating this intricate system mirrors the challenges of traversing a dense forest; while the thicket may obscure the path ahead, a meticulous approach illuminates the way, facilitating informed decisions in an otherwise opaque landscape. As financial policy continues to evolve, an astute understanding of the AMT’s characteristics will be integral to mastering the art of taxation in an ever-changing fiscal milieu.