In the field of economics, understanding aggregate demand is pivotal, as it encompasses the total demand for all goods and services in an economy at a given overall price level and within a specified time frame. Several factors catalyze shifts in aggregate demand, influencing economic performance, expansion, and contraction. This article elucidates the combinations of various elements that can most significantly enhance aggregate demand, thereby fostering a more prosperous economic environment.

1. Fiscal Policies and Government Spending

Government expenditure plays an instrumental role in boosting aggregate demand. When a government increases its spending on public goods and services, it directly influences the demand for these inputs. This can include infrastructure projects, education, and healthcare. For example, a surge in public investment in infrastructure can create jobs, augmenting disposable income, which subsequently leads to increased consumer spending.

Moreover, tax cuts represent another fiscal mechanism to elevate aggregate demand. By decreasing personal income taxes, consumers are afforded greater disposable income, allowing for higher consumption levels. This multiplier effect can stimulate broader economic growth as consumers engage in increased purchasing behavior.

2. Monetary Policy and Interest Rates

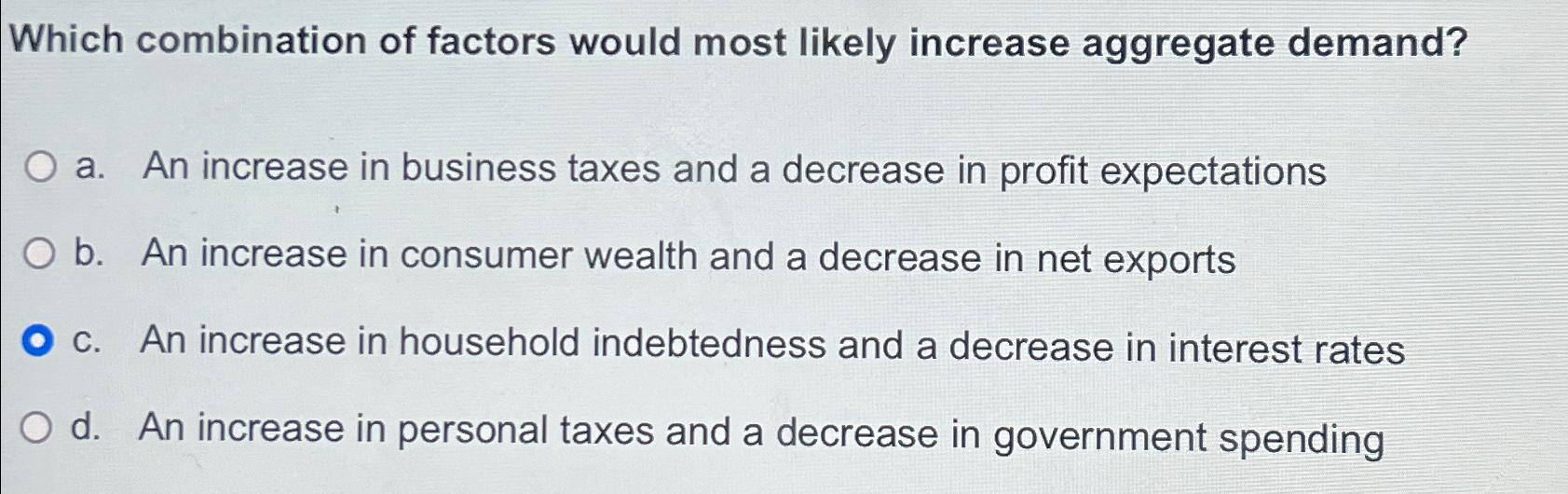

The role of monetary policy in influencing aggregate demand cannot be overstated. Central banks utilize interest rate adjustments as a primary tool to manage economic activity. A reduction in interest rates generally lowers the cost of borrowing, encouraging both consumers and businesses to take loans for expenditure and investment purposes.

Lowering interest rates can lead to an increase in consumer confidence as payments on existing debt decrease and new borrowing becomes more affordable. This influx of liquidity into the economy often translates to increased consumption, contributing to the upward shift in aggregate demand.

Conversely, easing credit conditions through quantitative easing allows financial institutions to lend more freely, further stimulating aggregate demand. The availability of credit fuels spending and investment, consequently engendering economic expansion.

3. Consumer Confidence and Expectations

Arguably, consumer confidence acts as a significant psychological factor influencing aggregate demand. When consumers anticipate favorable economic conditions—such as high employment levels and increasing incomes—they are more inclined to spend. Elevated consumer confidence can lead to a self-fulfilling cycle where increased spending by consumers encourages businesses to invest and expand, spurring further economic growth.

Conversely, negative sentiment among consumers, perhaps resulting from economic downturns or financial crises, can lead to reduced consumption. In this context, strategies aimed at bolstering confidence, such as effective communication of economic policies by the government or central bank, can help initiate a positive shift in consumer behavior.

4. Investment from Businesses

Business investment is another crucial determinant of aggregate demand. When companies are optimistic about future profits, they are likely to invest in new projects, technologies, and workforce expansion. This capital expenditure creates new jobs and enhances productivity, which concurrently raises consumer incomes and demand.

Additionally, an increase in business investment in research and development can foster innovation, leading to the creation of new products and markets. This innovation drives demand not just directly, but also indirectly by stimulating associated industries through supply chain effects.

5. External Factors: Net Exports

The performance of an economy on the global stage also influences aggregate demand through net exports. A rise in demand for a country’s exports boosts overall economic activity, leading to higher production and employment levels domestically. Policies that enhance the competitiveness of domestic industries on international markets should, therefore, be tailored to increase overseas demand for local products.

Moreover, a weak domestic currency can augment export appeal, as it lowers the prices of domestically produced goods for foreign buyers. This increase in export-driven consumption shores up aggregate demand effectively, subject to other economic conditions remaining favorable.

6. Population Dynamics

Demographic changes can significantly impact aggregate demand. An increasing population generally leads to higher consumption levels due to the greater demand for housing, goods, and services. Migratory trends can also play a role, as an influx of people into a region can stimulate local economies and enhance overall demand.

Additionally, changes in age demographics may shift consumption patterns. For example, an aging population may increase demand in sectors like healthcare, while a younger demographic may drive demand in technology and entertainment.

7. Global Economic Conditions

The interconnectedness of global economies means that foreign economic conditions significantly impact domestic aggregate demand. In an increasingly globalized world, economic booms or recessions in major economies can have ripple effects on aggregate demand. For instance, if a significant trading partner is experiencing economic growth, demand for exports may increase, thereby enhancing domestic economic performance.

The interaction between domestic policy measures and global economic conditions often necessitates a nuanced approach for policymakers. Staying attuned to global trends enables nations to adapt their strategies to leverage opportunities for increasing aggregate demand.

Conclusion

In summary, the combination of fiscal and monetary policies, consumer confidence, business investment, external trade dynamics, population demographics, and global economic conditions collectively contribute to the elevation of aggregate demand. An adept understanding of these interwoven factors allows policymakers and economists to engender a robust economic environment conducive to sustained growth. The delicate balance of these forces underscores the complexity of modern economies and the critical nature of informed decision-making in fostering aggregate demand.