American Express (AmEx) is synonymous with prestige and premium customer service, often attracting inquisitive minds interested in understanding the inner workings of its credit processes. This inquiry is particularly pertinent when considering the credit check methodologies employed by this storied institution. A critical aspect of this inquiry revolves around which credit bureau American Express utilizes for credit evaluations. This article explores the nuances behind this decision, the implications for consumers, and what it reveals about the credit landscape.

The primary credit bureaus operating in the United States—Experian, TransUnion, and Equifax—each maintain an extensive repository of consumer credit information. American Express occasionally utilizes the services of all three but manifests a clear preference for one over the others. While it may vary based upon geographical location and specific financial products, it is widely understood that American Express predominantly relies on Experian for its credit checks. Understanding this association is fundamental for potential cardholders to navigate their financial engagement better with AmEx.

To comprehend why American Express predominantly collaborates with Experian, one must consider several facets of the credit evaluation process. First, credit bureaus differ in their methodologies for collecting and assessing consumer data. Experian, in particular, boasts a robust infrastructure that excels in delivering accurate and timely credit information, which is essential for a company like American Express that prides itself on its credit evaluation precision. This verification facilitates a streamlined experience for both AmEx and its customers, fostering trust and satisfaction.

Moreover, the varying metrics utilized by credit bureaus to assess creditworthiness tend to convey diverse strengths and weaknesses. For instance, Experian is known for its holistic view of consumer financial behavior, often incorporating innovative analytics into its reporting practices. This analytic prowess affords American Express a more nuanced portrait of potential cardholders, allowing for more tailored credit offerings. AmEx seeks consumers who not only maintain a favorable credit score but also exhibit responsible financial behavior—a principle closely aligned with Experian’s reporting strategies.

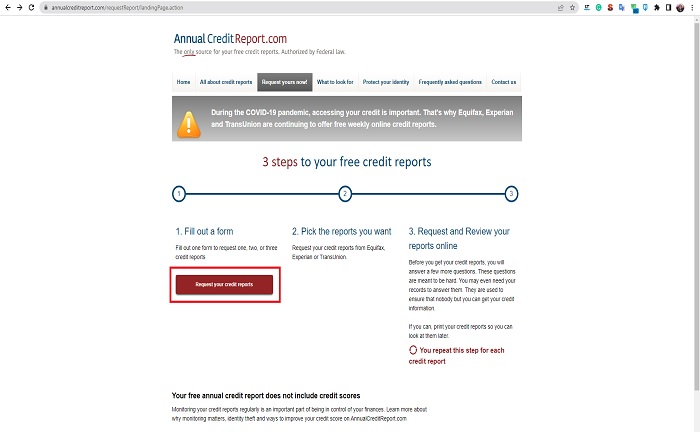

However, it is imperative to consider how this preference affects consumers seeking American Express credit products. The nature of one’s credit history with Experian will undoubtedly influence the outcome of an application. Thus, it is astute for potential applicants to monitor their Experian credit report, as a robust credit history can significantly bolster one’s odds of receiving favorable credit terms. Furthermore, understanding the distinguishing parameters of one’s credit report can illuminate pathways to improvement. Reports from Experian often include detailed breakdowns of credit utilization ratios, payment histories, and inquiries that can help inform consumers about the areas needing attention.

In addition to understanding which bureau AmEx uses and why it matters, one must also appreciate the broader implications within the credit landscape. The choice of a primary credit bureau reveals insights into AmEx’s overarching strategy. By opting for Experian, American Express aligns itself with a provider recognized for rigorous data collection and innovative predictive analytics. This collaboration fortifies AmEx’s commitment to prudent lending practices while supporting its aim to mitigate risk—a strategic necessity in an increasingly competitive financial environment.

Nonetheless, the intricacies surrounding credit card applications are not solely dictated by the choice of credit bureau. The comprehensive credit assessment process encompasses various elements, including income verification, debt-to-income ratios, and existing credit lines. As such, American Express demonstrates due diligence through an amalgamation of data points while ultimately favoring the insights provided by Experian’s credit assessments. This multifactorial approach thus enables AmEx to present tailored offerings—such as premium rewards or lower interest rates—based not just on credit scores, but on the intricate tapestry of individual financial behaviors.

Understanding American Express’ operational dynamics extends beyond the mere identity of the credit bureau they rely on. It fosters a more profound comprehension of consumer behavior in relation to credit management. AmEx’s preference for Experian offers a roadmap for consumers to navigate their credit strategies effectively. By elevating their engagement with their Experian report, consumers can engage proactively in maintaining or enhancing their credit profiles, thereby maximizing their potential for favorable credit outcomes.

Furthermore, this relationship between American Express and Experian invites an exploration of the consumer credit ecosystem. The reliance on one bureau indicates a broader industry trend whereby financial institutions may favor certain credit reporting systems over others based on their unique risk assessment methodologies. The ramifications of these preferences illuminate a complex interplay between creditors, consumers, and credit bureaus—a dynamic that incumbents and new entrants alike must continually navigate.

In conclusion, while American Express exhibits a propensity for utilizing Experian in its credit evaluations, the fabric of consumer credit extends far beyond this singular relationship. Prospective applicants must be acutely aware of their credit profiles as well as the respective reporting practices of the preferred bureau. Thus, enhancing one’s understanding of these variables not only equips consumers with critical insights but also reinforces the importance of an informed approach to credit management. As the credit landscape continues to evolve, the necessity for vigilance and adaptability remains imperative for us all.