In the landscape of personal and professional organization, the receipts folder often serves as a repository for proof of purchase, a chronicle of financial transactions, and a tangible reminder of one’s fiscal footprint. However, as myriad documents seem to cascade into our lives, the question of creating efficiencies within this domain arises: Which folder could be logically combined with the receipts folder to enhance its utility and optimize organization? To ascertain this, we must first appreciate the nature and nuances of the receipts themselves.

By delving into the essence of the receipts folder, we can discern that its contents are not merely remnants of consumer transactions; instead, they represent pivotal moments of expenditure. Each receipt chronicles an exchange, whether it be for sustenance, clothing, or intangible services. Yet, receipts can often be ephemeral in significance, reduced to mere paper remnants unless contextualized within a broader framework. Therefore, the ideal candidate for amalgamation with the receipts folder should ideally augment its purpose, whilst enhancing the overall organization.

One compelling option for logical combination is the Expense Reports Folder. Just as the roots entwine beneath the soil, providing nourishment to the burgeoning plant above, so too do receipts provide foundational elements to the larger tree of financial understanding. Expense reports—including but not limited to travel expenses, business-related purchases, and daily operational costs—can be effectively paired with receipts. This tandem allows individuals to cross-reference receipts with their respective reports, engendering a seamless flow of information. Each expense report can be supplemented by the corresponding receipts, thus presenting an integrated picture of financial responsibility, while alleviating the burdens of cross-reference hassles.

Moreover, combining these two folders fosters an analytical mindset. By scrutinizing how each receipt correlates with broader spending patterns, one gains insights into behavior, budgetary constraints, and potential areas for cost reduction. This practice serves as the proverbial mirror, reflecting spending habits and illuminating paths toward improved financial stewardship.

In addition to the Expense Reports Folder, the Budget Planning Folder emerges as another viable candidate for amalgamation with receipts. This folder serves the purpose of mapping out financial trajectories, delineating both income and anticipated expenditures throughout fiscal cycles. Herein lies an intriguing metaphor: Much like a navigational chart guiding sailors through treacherous waters, the budget planning folder directs financial decision-making amidst the turbulent waves of economic uncertainty. By merging receipts with budgetary documents, individuals can cultivate a more profound understanding of where money is being allocated versus the planned budget. This allows for real-time adjustments, a crucial ability in an ever-changing financial landscape.

The crux of this collaboration lies in the integration of historical data with proactive planning. When receipts are preserved alongside budget documents, one can scrutinize variances between actual spending and projected expenditure. This not only promotes accountability but also empowers individuals to recalibrate their financial strategies as necessary. As in nature, where predators adapt to changing environments for survival, so too must individuals adapt their budgets in response to unavoidable financial patterns.

Next, let us consider the potential advantages of merging the receipts folder with a Returns & Warranties Folder. This folder acts as a safeguard for consumer rights and protection against unforeseen circumstances. When receipts are consolidated with warranty and return policies, they transform into instruments of leverage—a means to reclaim funds or replace unsatisfactory products. Imagine if each receipt is a key in a labyrinth, unlocking passageways to returns, exchanges, or warranties. In this scenario, combining these folders affords peace of mind, ensuring that one’s financial investments are not merely momentary but protected against the vagaries of consumer goods.

Furthermore, this amalgamation facilitates quicker retrieval of essential documents. In moments of urgency, having the receipts alongside warranty information can prevent the exasperating experience of sifting through a disorganized stack of papers, transforming potential chaos into serene order. This synergy creates a comprehensive archive of transactions, replete with protective measures, thus enhancing overall organizational efficacy.

Additionally, one might contemplate the merits of merging the receipts folder with a Tax Documents Folder. This is particularly profitable during the annual ritual of tax preparation, where clarity and organization become paramount. By collating receipts with relevant tax documents, such as 1099 forms and other income statements, one can streamline the often-daunting process of tax filing. Here, receipts become more than mere paper; they transform into vital assets that substantiate deductions, validate expenses, and facilitate a more straightforward tax return. Without question, this amalgamation elevates the receipts folder from a passive collection to an active participant in financial integrity.

Lastly, consider constructing a link to a folder dedicated to Financial Goals. Just as a lighthouse beckons sailors to safety, the pursuit of financial goals offers direction and purpose in one’s economic endeavors. By aligning receipts with documented objectives—whether they entail saving for a significant purchase, retirement, or debt reduction—individuals gain a qualitative understanding of how their spending is aligned with their aspirations. This synergy transforms receipts into a roadmap, guiding individuals in their journey toward financial zeniths.

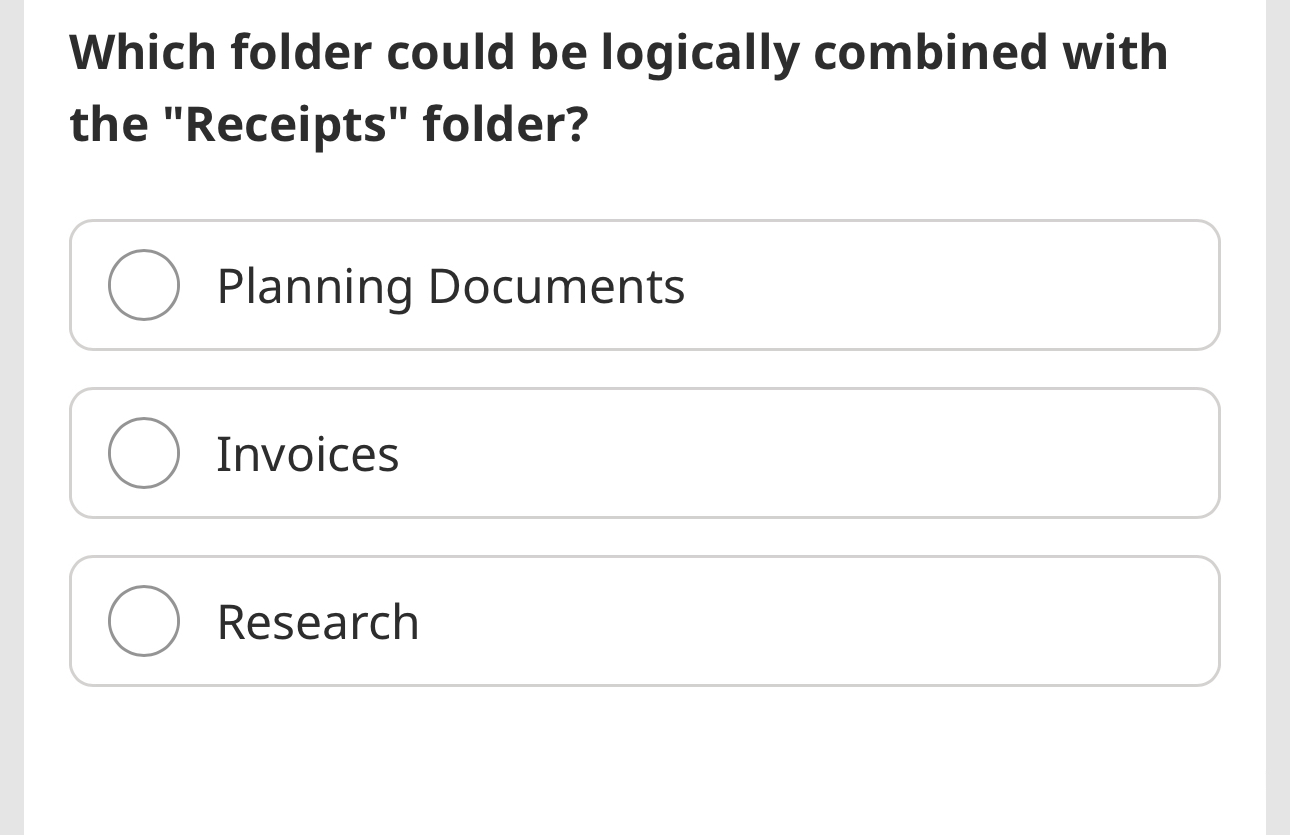

In conclusion, the inquiry regarding which folder could be logically combined with the receipts folder reveals a multitude of compelling opportunities. Whether through merging with the Expense Reports Folder, Budget Planning Folder, Returns & Warranties Folder, or Tax Documents Folder, each combination serves to enrich the significance of receipts in one’s financial life. By fostering deeper comprehension, enhancing accountability, and elevating organization, these integrations ultimately herald a more holistic approach to financial management. Embracing such synergies transforms the humble receipts folder into a veritable cornerstone of personal finance, inviting individuals to navigate the realms of their financial lives with confidence and clarity.